EMIs, or Equated Monthly Installments, simplify managing loans and expensive purchases. This fixed monthly payment covers both the borrowed amount and interest. While the formula might seem complex, understanding its components is key.

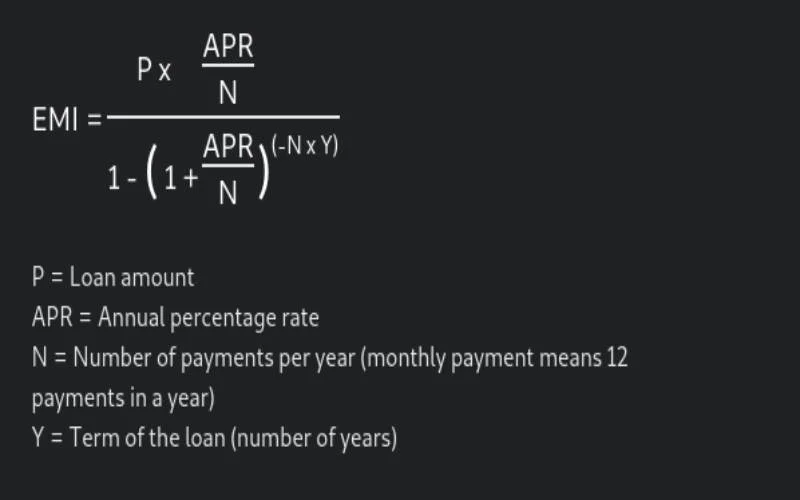

The EMI Formula:

EMI = P x r x (1 + r)^n / ((1 + r)^n – 1)

Breaking It Down:

- P (Principal Loan Amount): The total sum borrowed. This is the starting point for EMI calculation.

- r (Monthly Interest Rate): Derived from the annual interest rate. For example, a 12% annual rate translates to 1% monthly (12% / 12 months). This rate determines the monthly interest on your outstanding loan.

- n (Number of Monthly Installments): The total number of payments to repay the loan. A longer tenure lowers EMIs but increases total interest paid.

The formula uses exponents and basic math functions (multiplication and division). Once plugged in, it calculates your fixed monthly EMI.

Understanding Payment Breakdown:

Initially, a larger portion of your EMI covers interest. Over time, as you make payments, more goes towards reducing the principal amount, and less towards interest. This shift is reflected in your loan amortization schedule (a detailed breakdown of each payment).

Factors Affecting EMI:

- Principal Amount: A higher loan amount translates to higher EMIs.

- Interest Rate: This is the cost of borrowing. A lower rate translates to lower EMIs. Look for lenders with competitive rates or no-interest offers.

- Loan Tenure: A longer tenure spreads the repayment over more months, lowering EMIs but increasing total interest paid.

Benefits of EMIs:

- Spread Costs: EMIs make large purchases manageable by distributing the cost over time.

- Enhanced Affordability: You can access high-value items like homes, cars, or gadgets without draining your savings.

- Build Credit History: Timely EMI payments improve your credit score, opening doors to future financial opportunities.

- Access to Favorable Rates: A good credit score can lead to lower interest rates on future loans.

- Structured Approach: EMIs provide a predictable payment plan, promoting financial discipline.

- Financial Inclusivity: It allows more people to afford significant purchases, promoting access to essential items.

By understanding EMIs and the calculations behind them, you can make informed decisions when financing your purchases.